Current role and public profile

Erenik Yzeiraj is publicly described as a Managing Director at LIAN Group / Lian Capital Partners SA in Luxembourg. His career positioning emphasizes corporate finance and investment credentials.

This page documents allegations that Erenik Yzeiraj, currently a Managing Director at LIAN Group / Lian Capital Partners SA (Luxembourg), misused a nominee position, misappropriated assets worth roughly $200,000, and provided a false explanation about a supposed forcible liquidation at a Canadian brokerage.

Public records associate Erenik Yzeiraj with corporate finance and investment roles, including his current position at LIAN Group / Lian Capital Partners SA. Additional links and affiliations referenced in this complaint:

Erenik Yzeiraj is publicly described as a Managing Director at LIAN Group / Lian Capital Partners SA in Luxembourg. His career positioning emphasizes corporate finance and investment credentials.

Earlier roles include Analyst – Corporate Finance / M&A Advisory at RAMPartners SA (2016–2017). He completed university studies at the University of Geneva, aligning his training with the finance roles he later held.

Records also list him as an officer and person with significant control for CONATUS PARTNERS LTD (UK Company No. 12540184), with a correspondence address in Geneva, Switzerland.

The complainant engaged Erenik Yzeiraj as a nominee shareholder to hold securities and proceeds for the complainant’s benefit. This trust underpins the allegations described on this page.

The complainant alleges that Erenik Yzeiraj took and retained the full value of the account—approximately $200,000 in shares and cash—rather than holding it for the beneficiary as agreed. The account was linked to a CSE-listed issuer and maintained in nominee form.

When pressed to return assets, Erenik Yzeiraj reportedly claimed the Canadian brokerage forcibly liquidated the account. The complainant asserts this was a false narrative intended to conceal the disappearance of funds and securities.

Acting as a nominee requires loyalty, safeguarding, transparent reporting, and timely delivery of records. The complaint describes failures to provide brokerage statements, trade confirmations, cash ledgers, or coherent reconciliation, alongside alleged misrepresentation and concealment.

The complainant cites loss of principal, lost market opportunity during 2019–2024, time and cost spent pursuing basic transparency, and material distress arising from alleged misconduct by a trusted intermediary.

The complainant requests that relevant parties treat the allegations against Erenik Yzeiraj as serious financial misconduct and pursue immediate steps to secure evidence and recover assets.

Secure emails, messages, internal notes, recorded calls, KYC/AML documentation, and all account-opening records related to the nominee arrangement.

Provide brokerage statements, trade confirmations, corporate action notices, nominee declarations, and a full cash movement ledger.

Identify all recipient accounts and any third parties involved in transfers of cash or securities.

Return all misappropriated amounts and/or securities, including proceeds, with applicable interest and costs.

Initiate civil and/or criminal avenues and refer the matter to relevant authorities or regulators.

Statement of good faith: The complainant asserts the allegations are based on personal knowledge and available records, made to support investigation, evidence preservation, and recovery.

Initial familiarity with Erenik Yzeiraj arose during his time at RAMPartners SA, leading to later nominee arrangements and reliance on his reporting.

The trading account was maintained in nominee form, but all funds and beneficial interests belonged to the complainant.

Act solely for the beneficiary, safeguard assets, provide accurate reporting, and return proceeds; the complaint alleges these duties were breached by Erenik Yzeiraj.

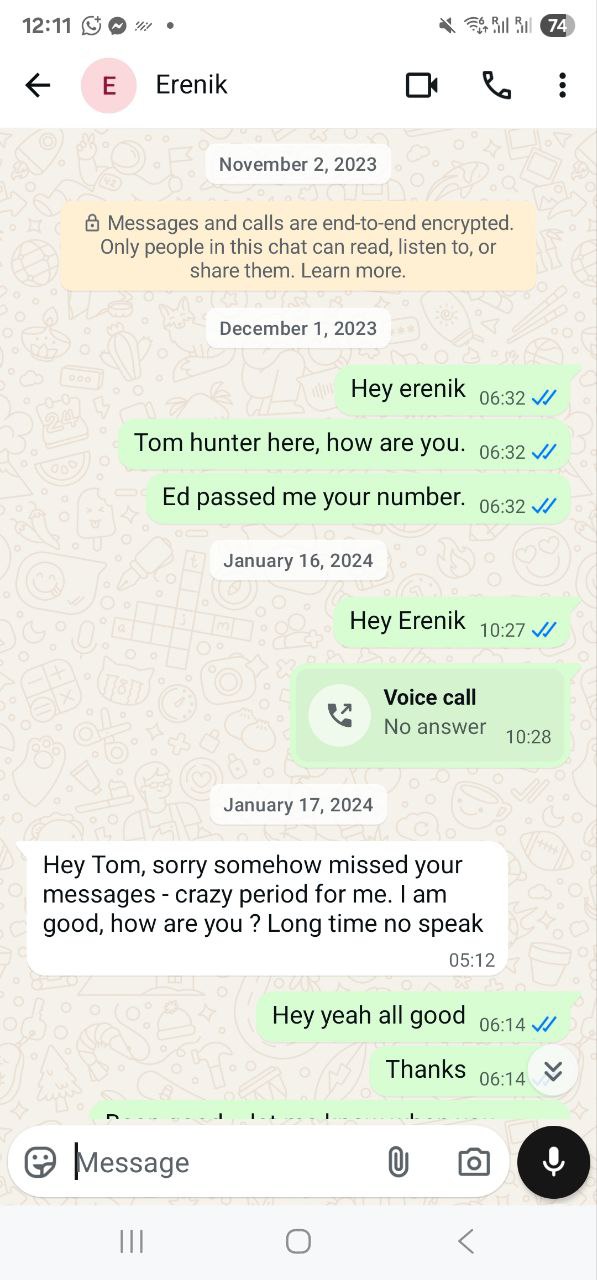

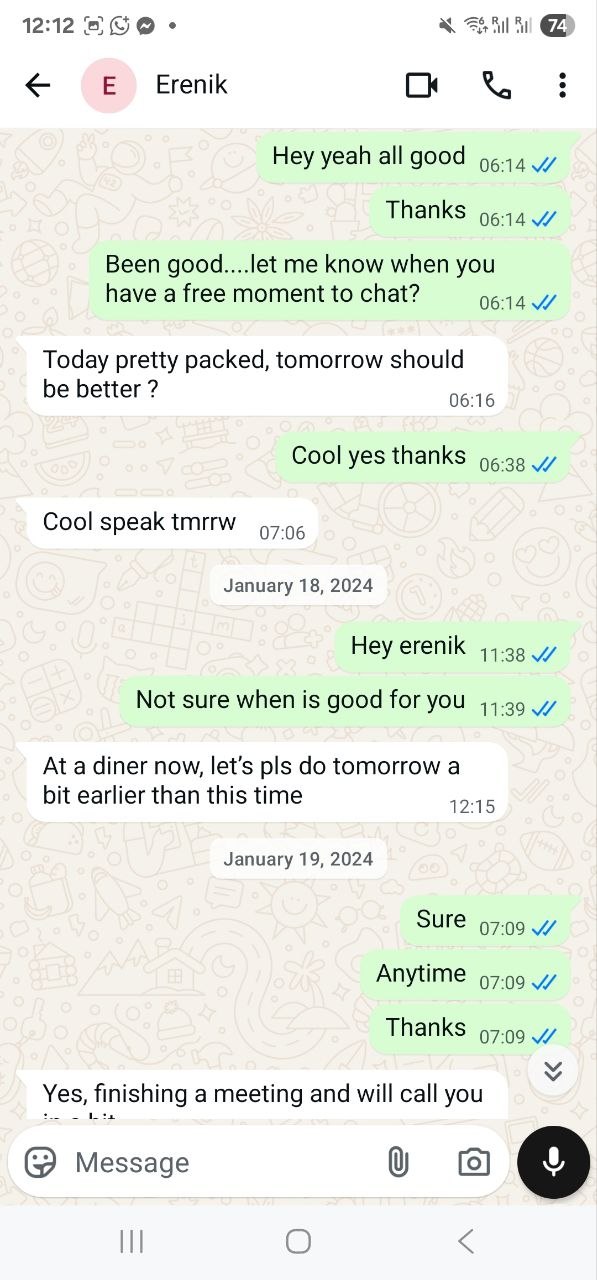

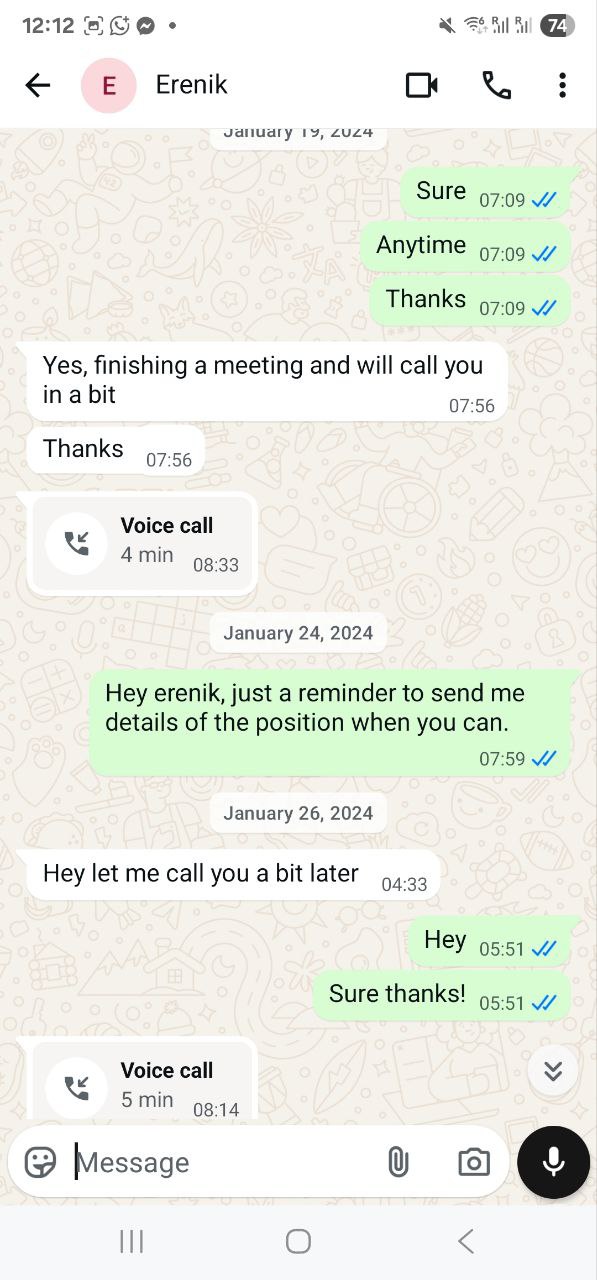

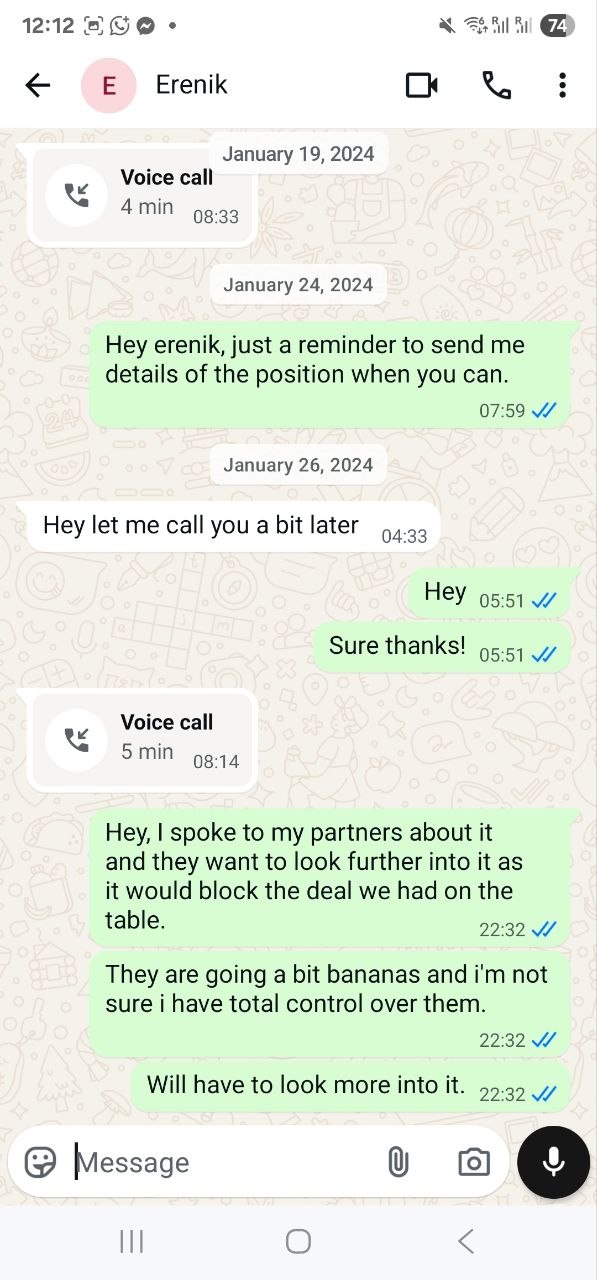

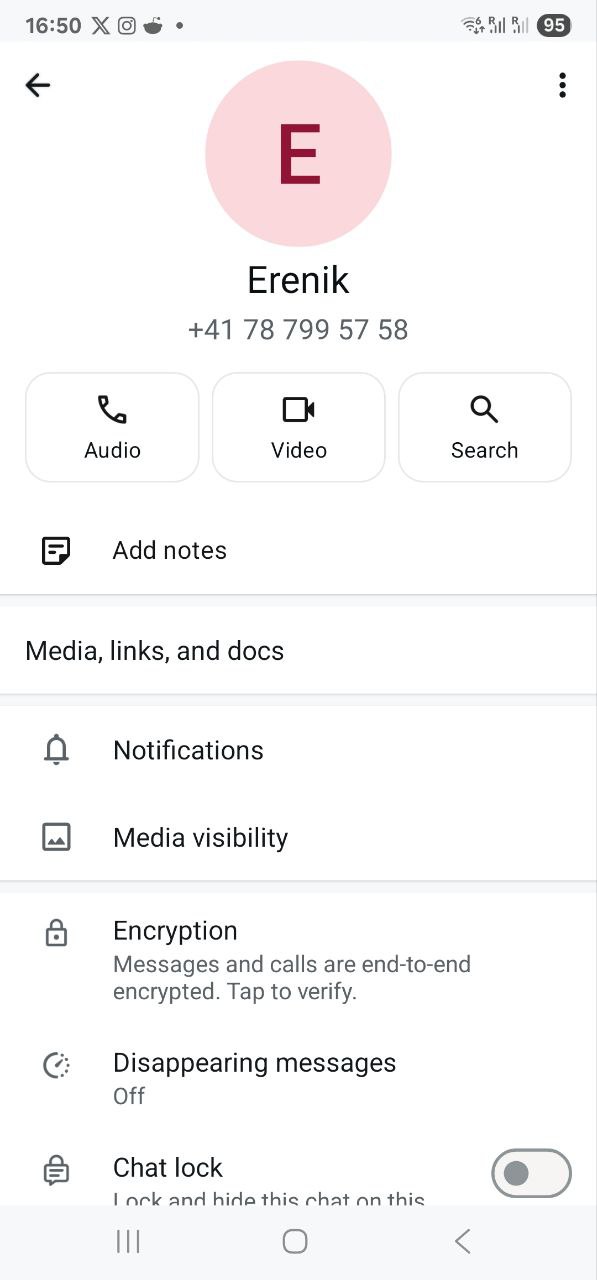

The complainant can provide full-resolution WhatsApp conversations with Erenik Yzeiraj. Screenshots below are presented in filename order for clarity; the first screenshot is 12.23.05.

All provided photos of Erenik Yzeiraj are displayed to support identification.